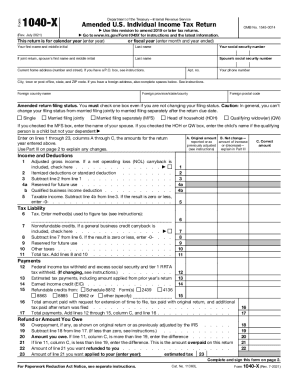

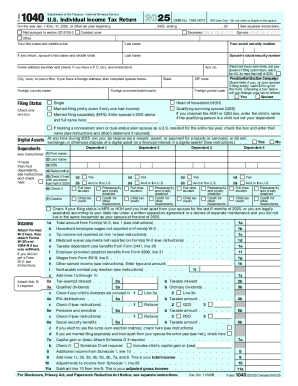

IRS 1040-X 2024-2026 free printable template

Instructions and Help about IRS 1040-X

How to edit IRS 1040-X

How to fill out IRS 1040-X

Latest updates to IRS 1040-X

All You Need to Know About IRS 1040-X

What is IRS 1040-X?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040-X

What should I do if my IRS 1040-X is rejected during e-filing?

If your IRS 1040-X is rejected, check the provided rejection codes to identify the issue. Common reasons include mismatched identification details or errors in the amended entries. Once corrected, you can resubmit your form, ensuring all information is accurate to minimize further rejections.

How can I verify if my IRS 1040-X was received and is being processed?

To verify the status of your IRS 1040-X, you can use the IRS 'Where's My Amended Return?' tool available on their website. This tool provides updates on the processing status, typically available 3 weeks after submission, allowing you to track the progress of your amended return.

What are common errors that can occur when submitting IRS 1040-X?

Common errors when submitting IRS 1040-X include providing incorrect personal identification details, failing to sign the form if filing by paper, and neglecting to include necessary supporting documentation. To avoid these pitfalls, meticulously review your form and ensure all sections are complete and accurate.

Is e-signature acceptable when filing an IRS 1040-X?

Yes, e-signatures are acceptable when filing an IRS 1040-X electronically. However, if you are submitting a paper version, ensure you provide a handwritten signature to validate your submission. Always check the IRS guidelines for any updates on electronic filing procedures.

See what our users say