IRS 1040-X 2024-2025 free printable template

Show details

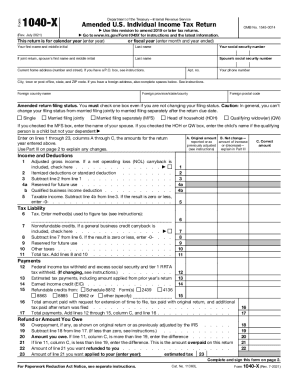

Form 1040X Rev. January 2017 Department of the Treasury Internal Revenue Service Amended U.S. Individual Income Tax Return OMB No. 1545-0074 Information about Form 1040X and its separate instructions is at www.irs.gov/form1040x. This is the amount overpaid on this return Amount of line 21 you want refunded to you. estimated tax. 23 Complete and sign this form on Page 2. For Paperwork Reduction Act Notice see instructions. Cat. No. 11360L Form 1040X Rev. 1-2017 Page 2 Part I Exemptions...

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 1040-X

A Detailed Approach to Editing Your Tax Returns

Guidelines for Completing IRS Form 1040-X

Understanding and Utilizing IRS Form 1040-X

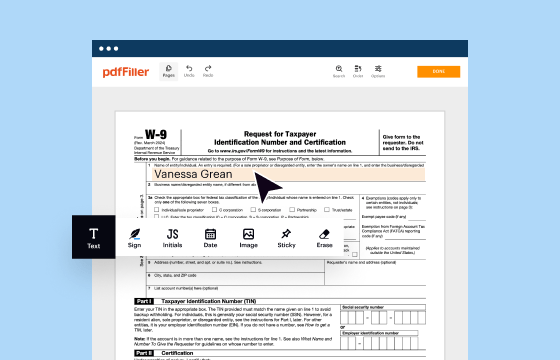

IRS Form 1040-X is crucial for taxpayers who wish to amend their previously filed tax returns. This form allows individuals to correct errors, update filing status, or claim overlooked credits or deductions. Utilizing this form not only ensures compliance with IRS regulations but also helps taxpayers to potentially receive additional refunds or settle any mismatched information with the IRS.

A Detailed Approach to Editing Your Tax Returns

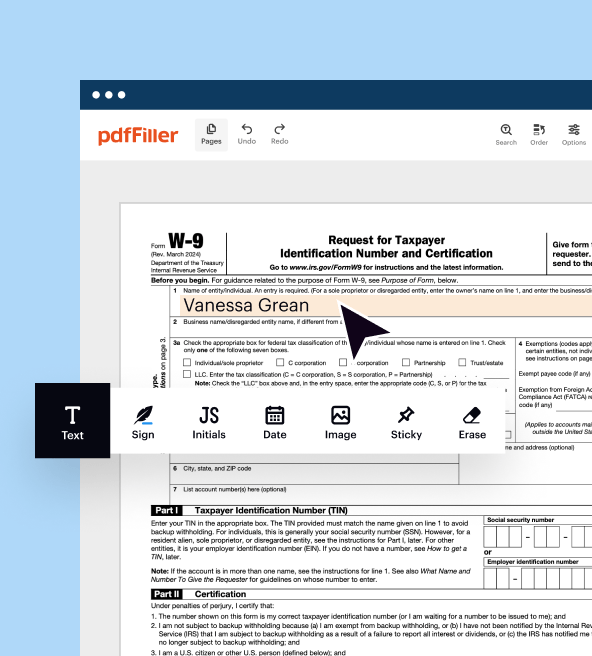

To successfully amend your tax return using Form 1040-X, follow these structured steps:

01

Obtain the latest version of IRS Form 1040-X from the IRS website.

02

Carefully review your original tax return to determine what changes need to be made.

03

Enter the correct information on Form 1040-X, ensuring you provide your original figures alongside the corrected amounts.

04

Clearly explain the reason for each amendment in the designated section of the form.

05

Calculate any new tax liability or refund that may result from your changes.

06

Sign and date the form before submitting it to the IRS.

Guidelines for Completing IRS Form 1040-X

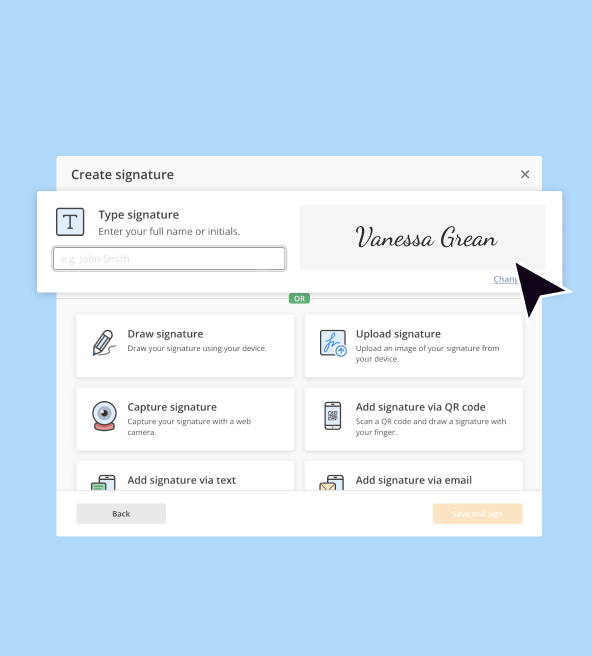

The process of filling out Form 1040-X involves several key components:

01

Personal Information: Include your name, address, Social Security number, and filing status.

02

Amendment Details: Clearly mark which lines on your original return are being corrected and the reasons for these changes.

03

Figures Adjustment: Provide both your old and new amounts for income, deductions, and credits.

04

Signature: Ensure that you sign and date the form, as it is a legal declaration.

Show more

Show less

Recent Developments Related to IRS 1040-X

Recent Developments Related to IRS 1040-X

Taxpayers should be aware of specific recent changes regarding Form 1040-X that can impact their filing process. In recent years, the IRS has streamlined the submission process and introduced a digital filing option for Form 1040-X, making it easier for taxpayers to amend their returns quickly and efficiently.

Essential Insights on IRS Form 1040-X

Defining IRS Form 1040-X

The Significance of IRS Form 1040-X

Who Needs to File This Form?

Eligibility for Form Exemptions

Understanding the Components of IRS Form 1040-X

Submission Deadlines for IRS Form 1040-X

Contrasting IRS Form 1040-X with Similar Forms

Covered Transactions for Form 1040-X

Copies Required for Submission

Potential Penalties for Failing to Submit Form 1040-X

Information Needed for Filing Form 1040-X

Other Forms to Include with IRS Form 1040-X

Where to Submit IRS Form 1040-X

Essential Insights on IRS Form 1040-X

Defining IRS Form 1040-X

IRS Form 1040-X is the official document used by taxpayers to amend their federal income tax returns. This form allows for corrections related to income, deductions, credits, or other discrepancies that may have been present in the originally filed return.

The Significance of IRS Form 1040-X

The primary purpose of Form 1040-X is to allow taxpayers to rectify errors that could potentially alter their tax liability. For example, if you qualified for a credit that you missed or made a mistake in your reported income, filing this form can amend your return and lead to a tax refund or reduce your tax owed.

Who Needs to File This Form?

Any taxpayer who finds errors in their original tax return should consider filing Form 1040-X. This includes individuals, families, and businesses who have made mistakes or need to include new information that affects their tax obligations.

Eligibility for Form Exemptions

Exemptions to filing Form 1040-X may apply in certain situations, such as:

01

Income below the filing threshold for your filing status.

02

Situations where your only income was from tax-exempt sources.

03

Filing status changes that do not affect your tax liability.

Understanding the Components of IRS Form 1040-X

Form 1040-X consists of three main parts: Personal Details, Explanation of Changes, and the revised figures for your tax calculations. Each section plays a critical role in ensuring the clarity and correctness of your amendment.

Submission Deadlines for IRS Form 1040-X

The standard deadline for submitting Form 1040-X is three years from the date you filed your original return or two years from the date you paid your tax, whichever is later. Adhering to this timeline is essential to avoid missing out on potential refunds or the ability to amend your return.

Contrasting IRS Form 1040-X with Similar Forms

While IRS Form 1040-X specifically addresses amendments to standard individual returns, other forms such as 1045 and 1139 serve different purposes—1045 is used for claiming a quick refund due to a net operating loss, and 1139 is used primarily by corporations for similar reasons. Understanding these nuances can help you choose the correct form for your tax situation.

Covered Transactions for Form 1040-X

Common transactions that require amendments using Form 1040-X include changes to your filing status, changes in deductible expenses such as business expenses or medical costs, and adjustments in income due to corrected 1099 statements.

Copies Required for Submission

In most cases, you will only need to submit one completed Form 1040-X. However, if you are amending more than one tax return, you will need to fill out a separate form for each return you are amending.

Potential Penalties for Failing to Submit Form 1040-X

Failing to file Form 1040-X when required can lead to various penalties:

01

Financial Penalty: Failure-to-file penalties could result in fines from the IRS based on the amount of tax that remains unpaid.

02

Legal Consequences: Continued failure to correct tax errors may lead to audit risks or more severe penalties.

Information Needed for Filing Form 1040-X

When preparing to file Form 1040-X, gather the following information:

01

Your original tax return and any accompanying documents.

02

Any new documents or information to support the changes.

03

Details about credits or deductions that were previously missed.

Other Forms to Include with IRS Form 1040-X

Depending on the nature of your amendment, you may need to submit supporting forms and schedules that relate to your changes, such as a revised Schedule C for business income or other relevant forms.

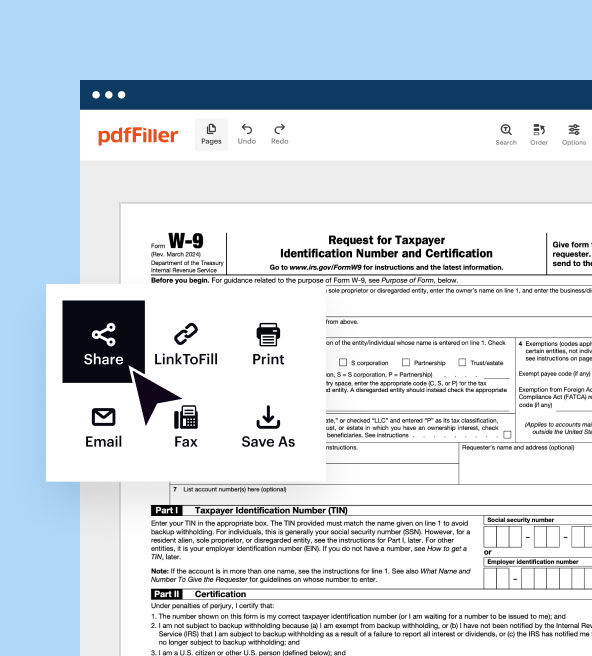

Where to Submit IRS Form 1040-X

Submit your completed Form 1040-X to the address indicated in the instructions for the specific state where you reside. Ensure you check the IRS website for the latest submission addresses as these can change periodically.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I went back to the OSHA 300 Form and filled out it out with no problems.

Not always intuitive but the functions are really nice.

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.